Celonis Payment Term Checker

Payment terms are crucial for your firm to manage cash flows, do financial forecasting and mitigate risk. Payment terms compliance issues can cause several issues like late payment fees, decrease in working capital, and even legal action and disputes. Process mining offers solutions for firms experiencing these issues and one of the newest solutions is The Celonis Payment Term Checker which compares payment terms on posted invoices, purchase orders and vendor master data to identify unfavorable mismatches.

tags

date

29 Aug 2023Why should I use the Payment Term Checker?

Payment terms often vary between 15-90 days and most often are either 30, 45 or 60 days. In order for a company to maximize their working capital, companies should not pay before these pre-specified payment terms. We often see discrepancies between the agreed payment terms with suppliers, and the payment terms stated on the invoice. Let’s say the agreed payment terms with a supplier are 60 days, but then the invoice states 30 days. These discrepancies often go unnoticed: the invoice is paid in just 30 days, while it could have been paid 30 days later if the agreements were followed. The pay term checker app recognised these discrepancies and finds mismatches between the “actual” pay terms (the invoice pay terms), and the “should have been” pay terms (the pay terms on either the PO or in the Vendor Master Data).

App Specifications

The app has three key benefits:

- It drives Free Cash Flow improvements by avoiding paying invoices too early due to unfavorable mismatches.

- It improves days payable outstanding (DPO) by maximizing available payment terms.

- It standardizes payment terms usage by identifying vendors with multiple terms or inconsistent usage of payment terms. The two most important indicators are the “better PO terms” and the “unfavorable mismatch vendor master data (VMD)”. The “unfavorable mismatch Vendor Master Data” shows the instances where the payment term specified in the master data is greater than the term in which the payment was satisfied.

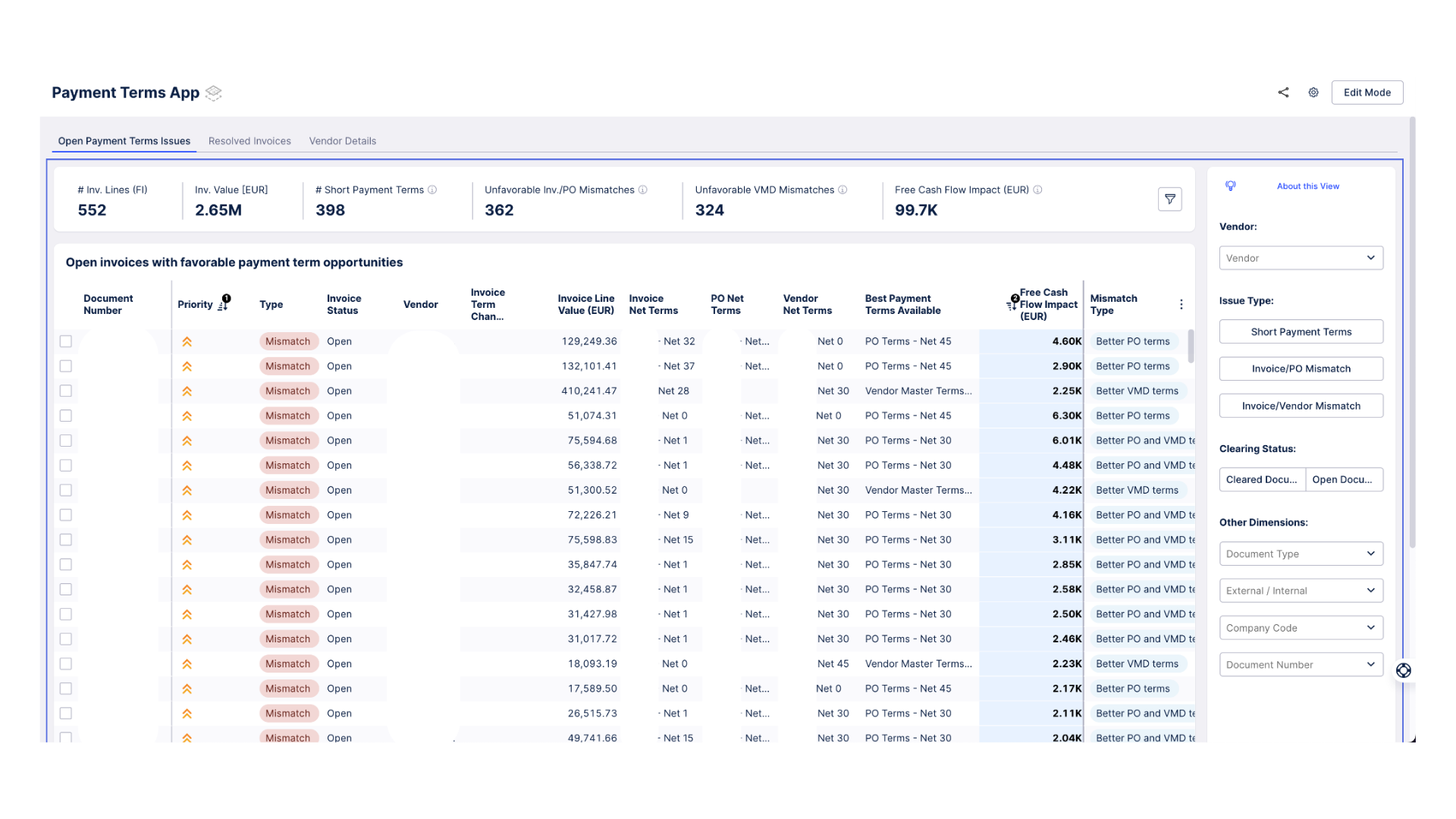

Overview of all invoices with unfavorable pay terms

(e.g. mismatch between invoice and PO or mismatch between invoice and vendor master data)

Anonymous and randomized data

Benefits for your firm

At Apolix, we already implemented the Payment Term Checker for multiple of our customers. The most important thing is the value we create for our customers. For this specific use case there are two main value points:

Increase in Working Capital

First, the most tangible benefit is the increase in Working Capital that is created when a company acts upon the mismatches found. With the payment term checker, your company can accelerate its free cash flow. The app gives the vendor master data payment terms and the particular payment terms for the invoice. If there is a mismatch between them, we know the difference in days. If the difference in days is positive (which means the invoice is paid before VMD term days) then that would impact working capital. There’s a formula to calculate the increase in working capital based on this difference. For example, if invoice value is 1 million and the positive difference is 20. Then the formula is (20/36) x (1M€) x (10%). Which would be a €5,479.50 increase in working capital.

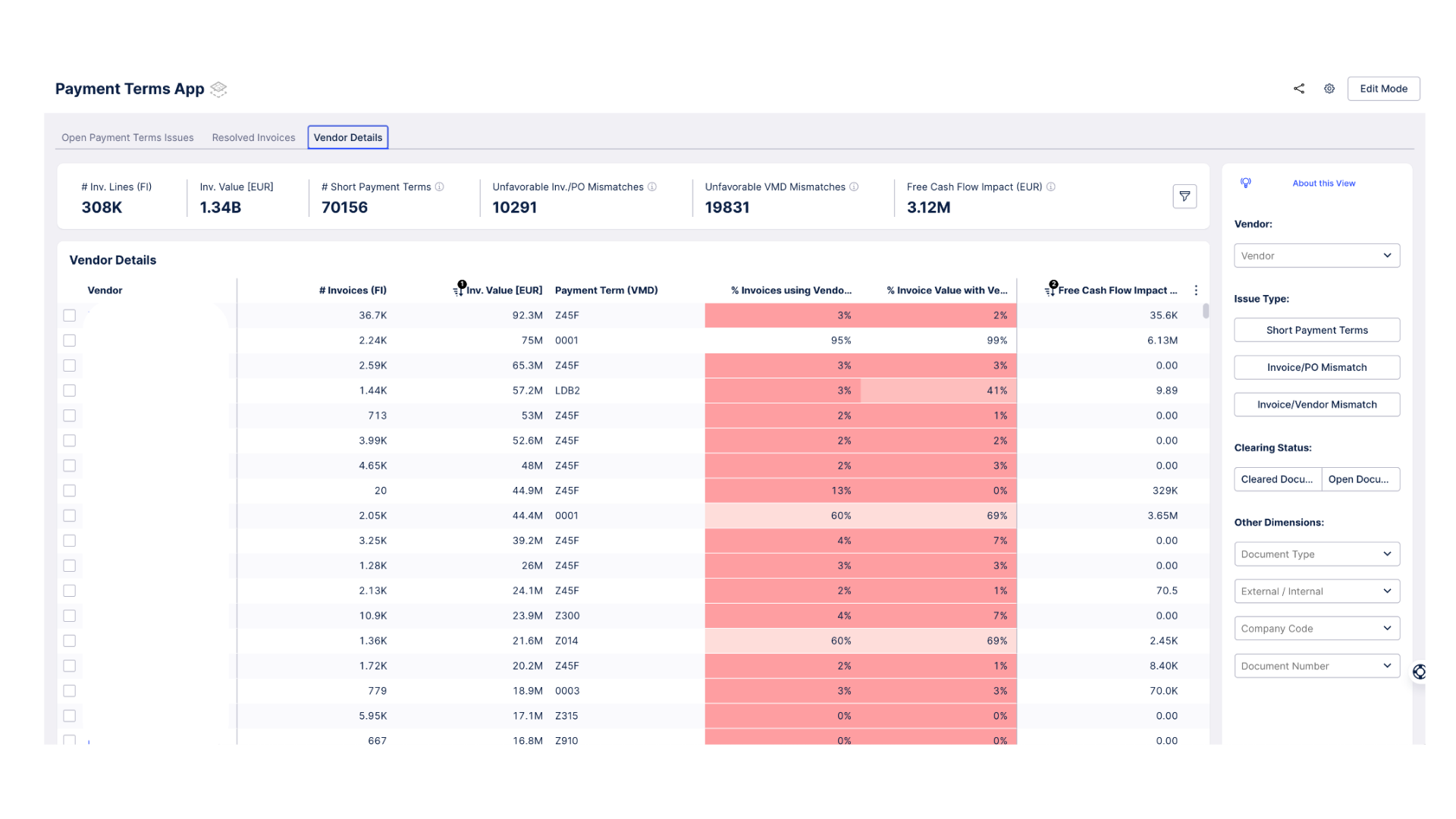

Overview of all vendors

ranked by the amount of pay term mismatches

Anonymous and randomized data

Insights into Account Payable processes

Next, one of the biggest values of process mining is found in the insights companies can find in their processes. A thorough understanding of your processes allows your company to have insights into for example AP processes and using these insights the process efficiency can be optimized and afterwards monitored to ensure compliance. For example, with the payment term checker app the process inefficiencies and thus early/late payments can first be identified, then improved and when the process is optimized, process mining can contribute to ensure that the payment term quality is maintained.

Conclusion

Apolix uses a value-first methodology. We go above and beyond to make sure that the insights from Celonis will drive change within an organization. Apolix can support your company when implementing the Payment Term Checker, a new solution that compares payment terms on invoices, purchase orders, and vendor data to identify mismatches. By using this tool, companies can maximize their working capital, avoid early payments, improve days payable outstanding (DPO), and standardize payment terms usage. The app provides three key benefits: driving Free Cash Flow improvements, optimizing DPO, and identifying vendors with inconsistent payment terms. Implementing the Payment Term Checker can increase working capital and provide insights into accounts payable processes, allowing companies to improve efficiency, optimize processes, and ensure compliance with payment terms. We at Apolix are ready to support your firm and if you are interested in receiving more information, you can contact us.